As we all know, today’s consumer expectations in finance have shifted to seamless, personalized interactions that go beyond traditional norms. Financial institutions, including banks, debt management firms, and loan providers, must adapt to changing preferences to remain competitive.

In this article, we aim to provide insight into financial institutions’ challenges and reasons for embracing digital and mobile solutions as indicators of the future success of customer interactions in the financial industry.

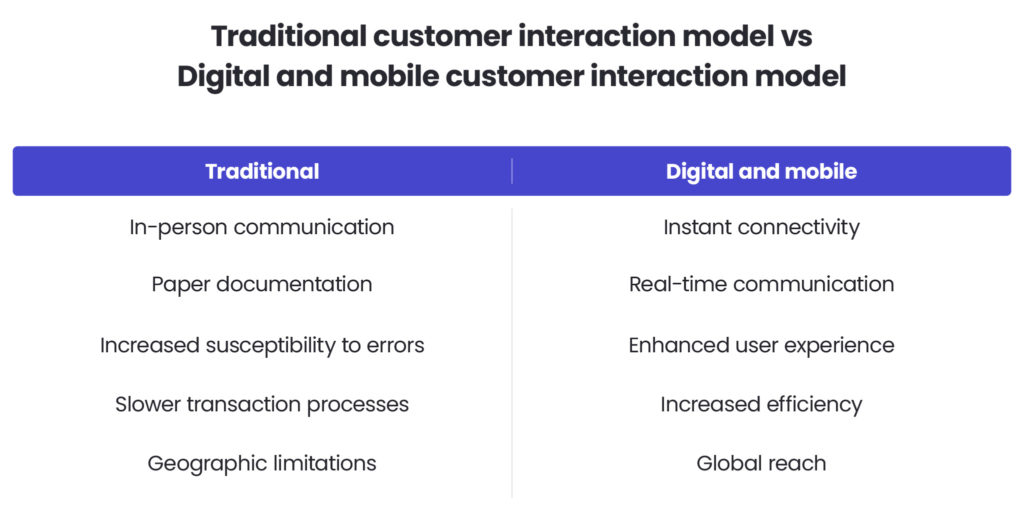

Traditional vs. digital and mobile customer interaction model

In the past, companies relied heavily on face-to-face meetings, phone calls and paper documentation to connect with customers. While this approach built personal connections and trust through direct communication, it came with many challenges. Geographic restrictions often limit companies’ reach, making connecting with customers in remote regions difficult. Moreover, the information exchange and transaction processes were slower and more error-prone, which impacted the quality of services and customer service.

As technology evolves, financial companies are increasingly adopting digital and mobile solutions. By implementing cutting-edge solutions, these institutions are able to offer instant connectivity, ensuring convenience, accessibility and the ability to conduct remote transactions from anywhere in the world. A digital approach defines the dynamic nature of the modern business environment, enabling greater reach and real-time communication.

Since many people use the mobile banking apps (mobile devices are approx. 75% of total use), businesses decide to take a step towards practical tools for professional customer service. Thanks to its visually attractive and intuitive interfaces that offer an easy user journey in the electronic channel, as well as up-to-date knowledge of the capabilities of the provided digital products, are seeing a significant increase in contracts signed through digital channels.

Why is an innovative approach essential to customers in the financial sector?

In finance, innovations improve the overall customer experience. Thanks to this approach, streamlined operational processes, and new technologies are available, ensuring safety while maintaining customer trust.

Innovative solutions often enable the use of financial services, allowing financial institutions to offer more profitable services to customers. The use of products available in different versions and digital extension promotes financial access and supports economic expansion.

Currently, the future of banking and fintech are Generation Z and Alpha customers. They have different needs, preferences and expectations than previous generations and demand greater digital experience from their financial service providers. Banks and fintechs that can offer mobile and digital solutions, education and financial advice will be able to attract and retain these customers as well as gain a competitive advantage in the market.

4 Technology themes that will have major impact on customer interaction model in 2024

Data themed personalisation

The ability to translate the abundance of data into customer experience touchpoints is still ahead of most banks and fintechs, but the few examples we have, are promising. To summarise, let’s take a look at the Monzo Bank campaign last December, which turned out to be a blast. While controversial, the campaign creatively addresses the challenge of generalising spending habits by using outdoor campaigns to compare trends between cities while maintaining user anonymity through data aggregation.

Accessibility and inclusions

With the new regulations around the corner, such as the European Accessibility Act (EAA), effective from June 28, 2025, improving inclusion in the digital channels will be an obligation to financial institutions in UE. At the same time, it’s already the only sound bet for providing financial services in the US and wishing to avoid potential legal actions. Bear in mind that accessibility is far more than contrast – in finance, it’s also very often about phrasing and cognitive load that all groups of users can easily understand, transparent forms, or cybersecurity patterns that can adapt to user skills in digital.

Conversational AI

With the arrival of GenAI, voice interfaces are becoming second nature to users (or first nature, since humans have relied on voice for millennia). If you have heard the story of Rabbit, a widely commented new gadget which allows you to talk with apps, you can probably imagine how disruptive the voice interface could be. At TechDotBit, we have a history of implementing voice solutions, and we believe that the ability to understand and automatically respond to most user questions is a must for most financial institutions. Voice bots are getting smarter, faster and cheaper to implement month by month, and a growing number of customers are getting used to talking with machines.

AI in design and communications

This year will still be about experimenting and learning how to apply new AI tools. Customers will experience more and better-tailored digital experiences. Design systems are starting to include prompting instructions relating to brand language and style. But that’s just one of the mirid use cases that AI workshops identify and discover.

At TechDotBit we love it when technology co-shapes experience

Design modern and customer-centric web applications

Designing modern, intuitive and easy-to-use apps is a must in the industry. For the last few years, 73% of users worldwide have turned to online banking at least once a month, while 59% use mobile banking apps and expect a flawless experience. Our design studio has been a part of this transformation, and new technologies offer more capabilities at way lower cost. Take eye-tracking, for example. For years, this was pricy research based on analysing fixation points of users’ pupils. Testing would require dozens of participants and expensive equipment. With AI, much of that can be simulated for a fraction of the cost, helping designers predict what will draw users eye attention.

We adopt top product design methodologies, but as a tech consultancy, we particularly enjoy leveraging new tools for digital customer experience. Our design studio works closely with development teams, and clients utilise their knowledge about client and technical possibilities.

With all the possibilities that technology opens up, it is also super important to ensure a consistent experience across all the touchpoints in the customer experience – at the end of the day, users interact with one brand, and they have to be able to transition smoothly between various platforms for their banking needs, e.g. by starting a process on a mobile and the continuing on their laptop.

Michal Kosztowny

Head of Design Unravel S.A.

Self-service portals and voice bots

Well-designed self-service debt or loan management applications are a blessing for clients and operations teams. The arrival of GenAI only boosts the capabilities of such solutions. As a company supporting established banks and fintechs with custom solutions, we know innovation is a process. Our past projects have brought significant savings for our clients by automating collections and improving loan management, making some of the processes easier for customers to handle and more accessible.

Being smartly active with sales

Perhaps the greatest opportunity for the finance industry is the ability to communicate at the right time and in the right way, explaining financial products to the users. At the same time, in this highly regulated industry, compliance and user preference need to be balanced. Mobile and web applications, chatbots and AI/ML-based solutions give the best chance to reach these goals. We managed to help our clients migrate the most advanced user journeys to make them mostly digitally signed agreements and reduce the duration of digital processes.

Custom solution development and existing systems improvements

We develop and design processes, solutions and digital tools in response to specific customer needs and to meet all desired requirements. In a complex banking ecosystem, a new solution usually requires integration with, and often impacts, other systems. At TechDotBit, we do not limit ourselves to creating new pieces of software, but we are happy to improve existing systems.

Explore how we boosted customer satisfaction for financial businesses

- Lending solutions for users to handle

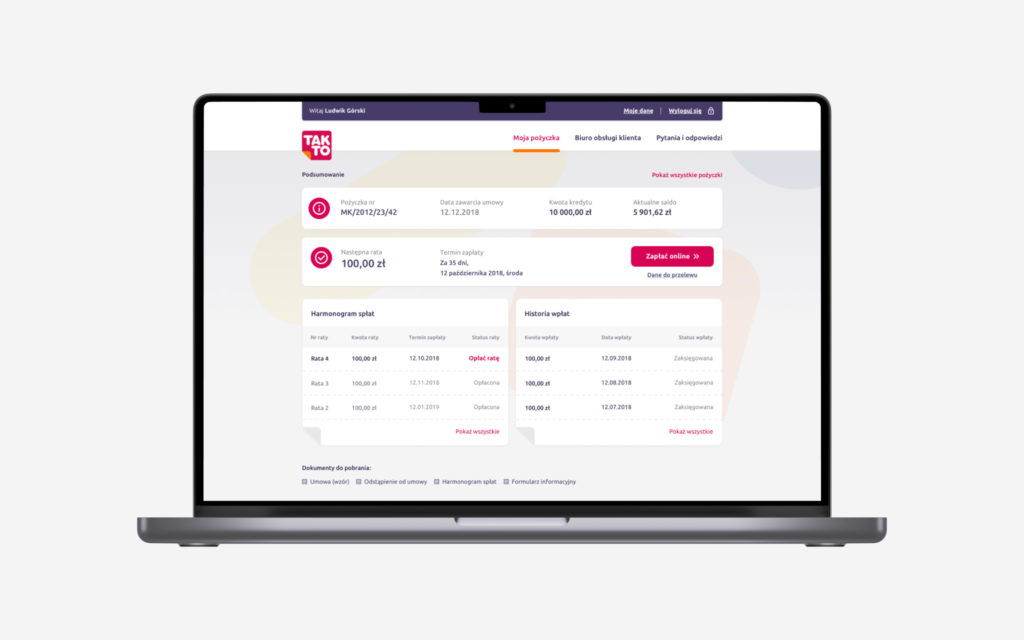

We helped TakTo Finance, a lending company from Poland, provide user-friendly lending services with a strong focus on customer experience. Their team wanted to update the way they communicate with customers and manage their database. As their technological partner, our activities were based on creating:

TakToEasy chatbot – a comprehensive customer service tool that responds to inquiries even when no customer service representatives are available, which resulted in an increase in the number of loan applications.

Customer dashboard – a contact point for communicating with customers and enabling them to directly submit loan applications and manage their liabilities online.

Migration of data and applications to the AWS cloud – our developers designed a new application architecture and planned a way to transfer data to new locations while maintaining all security protocols.

After delivering the entire ecosystem, we are currently responsible for maintaining and supporting the customer dashboard so that customers have constant access to their data.

- Self-service to allow personalisation of repayment terms

For Santander Bank Polska, we created a self-service online platform for debt restructuring, integrating it with the client’s online banking services, thanks to which the time needed to complete the entire process was shortened from about 2 weeks and 2 visits in branches up to 7 minutes.

Our key focus areas included technology integration, user experience, and efficiency gains in the debt management process.

Thanks to this solution, users can sign an annex or contract online, make overdue payments using an integrated payment service provider, or submit a request for contact regarding a specific product using an active form.

The platform meets all accessibility standards and is built using responsive web design ensuring better usability, so users can use the Bank’s offer anywhere.

For more examples of projects that we’ve worked on, check out our financial case studies here.

Make the customer interaction model a priority in 2024

Elevate your strategy for 2024 and align customer interaction models for digital and mobile solutions. If you don’t know where to start, we can definitely help you!

In case your project has different and more complex needs, we can work with you from start to finish. Partnering with TechDotBit ensures your service remains at the forefront of available technology, constantly adapting to the latest trends.

Visit our financial services page or contact an expert using the form below to learn more about how we can enhance your financial business.